Old Ownership Data Can Ruin Your Day

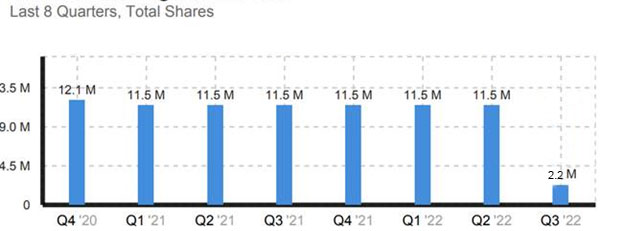

Imagine you are in a meeting with your investment bankers. In their presentation your entire team is blindsided by the fact that one of your largest institutional investors have sold a distressingly large block of shares. When you recently met with this investor the discussion included a slightly contentious issue, but nothing that seemed too serious at the time. You go back to your company’s investor relationship management system (“IRMs“) and it shows you the ownership history in the exhibit below:

The bank and the IRMs both show the sale of a large block. Given the fact that both sources of information agree, it might be tempting to believe that the sale occurred at the time shown and to blame the sale on the contentious issue.

Why Quality Ownership Data Matters

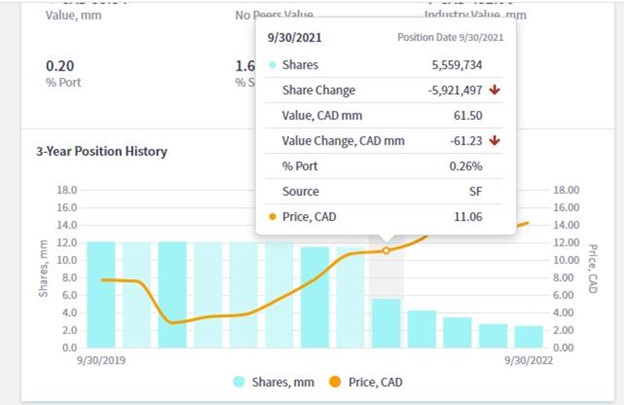

This is what happened to a client we recently started working with. They were deeply concerned by the apparent sudden sale of a large block of shares. The exhibit below is a screen capture of the historical ownership profile that we were able to access through a different investor relationship management system. Compare the exhibit below to the exhibit above. You can see that what appears to be a large block sale in the exhibit above actually began more than a year prior.

The large sale reported by the bank and the client’s IRMs was actually a true-up of stale ownership data. Without quality ownership data, our client was unaware of the investor’s year-long sales process. Furthermore, the company missed a key window of opportunity to address the sale. Outreach in Q4 2021 could have established the reason behind the sale, and provided a chance to address any misperceptions.

THE QUALITY OF DIFFERENT Ownership Data SOURCES

Access to trustworthy and current ownership data is essential to:

- Identify buyers and sellers of your shares in real time to address these movements in a timely manner.

- Establish the return on investment of your institutional marketing efforts.

- Understand the performance of your company’s investor relations program.

- Inform your quantitative, cross-peer, and thematic ownership analysis to identify relevant buy-side targets (Forget about your targeting exercise surfacing relevant investors if it’s based on stale data).

But bad/stale data will inevitably lead to the wrong conclusions. How do management teams differentiate between the quality of different data sources? Read on.

Surveillance

The most timely source of institutional ownership information is paid-for surveillance. The cost of this premium service is usually only justified for a company facing a hostile take-over bid or shareholder activism. The cost of surveillance is based on how often management requires ownership position updates.

InvestOR Relationship Management Systems

Investor relationship management systems (“IRMs”) represent the next most dependable source of institutional ownership data. However, their reliability depends on the data sources used by the IRMs and the cadence of that data being refreshed. Specifically, some IRMs are inconsistent in delivering Sum of Fund derived institutional ownership positions in a timely manner.

Every investor relationship management system will provide an institutional ownership report for your company. This report also provides the “Position Source”, which you can see on the far right of the exhibit below.

The ownership position sources in the green box are captured consistently across most IRMs systems. These sources include 13 F, Early Warning, Canada Alternative Monthly Report, Proxy, and insider filings. When compared between IRMs, the positions from these sources are virtually identical.

However, there is significant variation in the quality and timeliness of Sum of Fund data between IRMs (the yellow box). The inadequate timeliness of their Sum of Fund data is what led to our client missing the initial sale in the case study above. Your IR team must exercise caution here.

Which IRMs you choose matters much less if most of your owners report through 13 F or the other position sources in the green box. For example, most of Shopify’s owners are 13 F filers. However, for the vast majority of Canadian companies, Sum of Fund is the dominant source of ownership data. If your ownership report shows Sum of Fund as the position source for your key owners, then the selection of an investor relationship management system, and the scrutiny of its data quality, is critically important.