THe UN PRI, sustainability, and investor relations

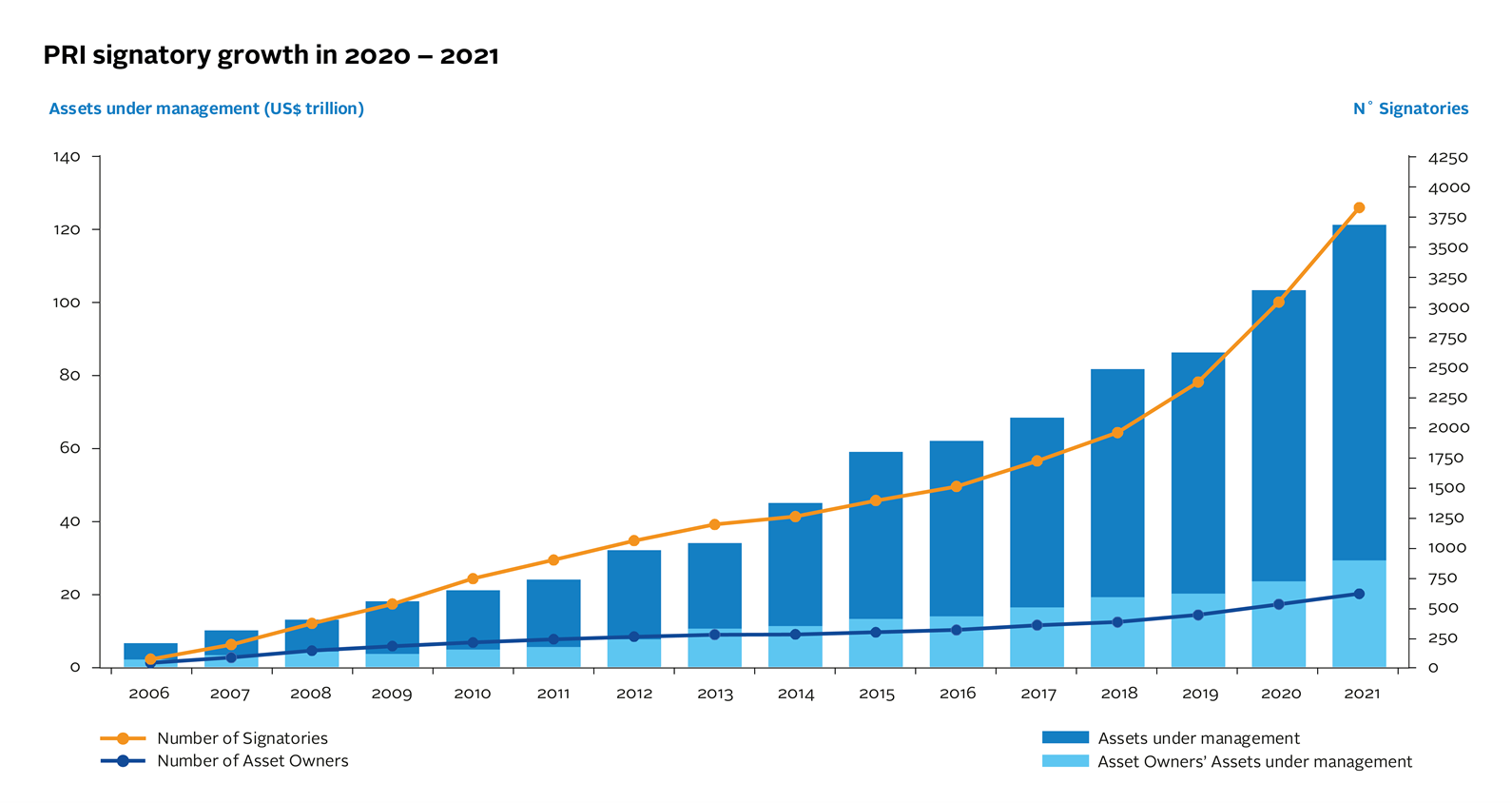

In 2021 there were 3,404 investment firms managing more than US$121 trillion that had signed on to the United Nation’s Principles of Responsible Investing (“UN PRI”). And the rate at which signatories and assets under management are coming under the UN PRI umbrella is growing exponentially. This means that sustainability and investor relations are now inextricably linked together.

Unfortunately, very few management teams are prepared to manage the risks posed by the:

- Continued proliferation of ESG frameworks;

- Rapid and at times irrational evolution of these frameworks;

- Lack of data integrity;

- Inability to control their company’s industry designation (which directly impacts ESG risk assessments);

- Impact of greenwashing and a market saturated with ESG messaging;

- Impending regulatory changes that will require companies to disclose emission and impact data; and

- Requirement for third party audit and assurance of sustainability data.

The Rapid Evolution of Sustainability’s importance

Let’s go back to the beginning of 2020. It’s right before pandemic lockdowns forced most of us to work from home. ATB is hosting their annual conference in Toronto followed by CIBC hosting their annual conference in Banff. The investors that management teams are meeting have few questions, if any, about sustainability and ESG. And there are few, if any, slides in the investor presentation dedicated to ESG.

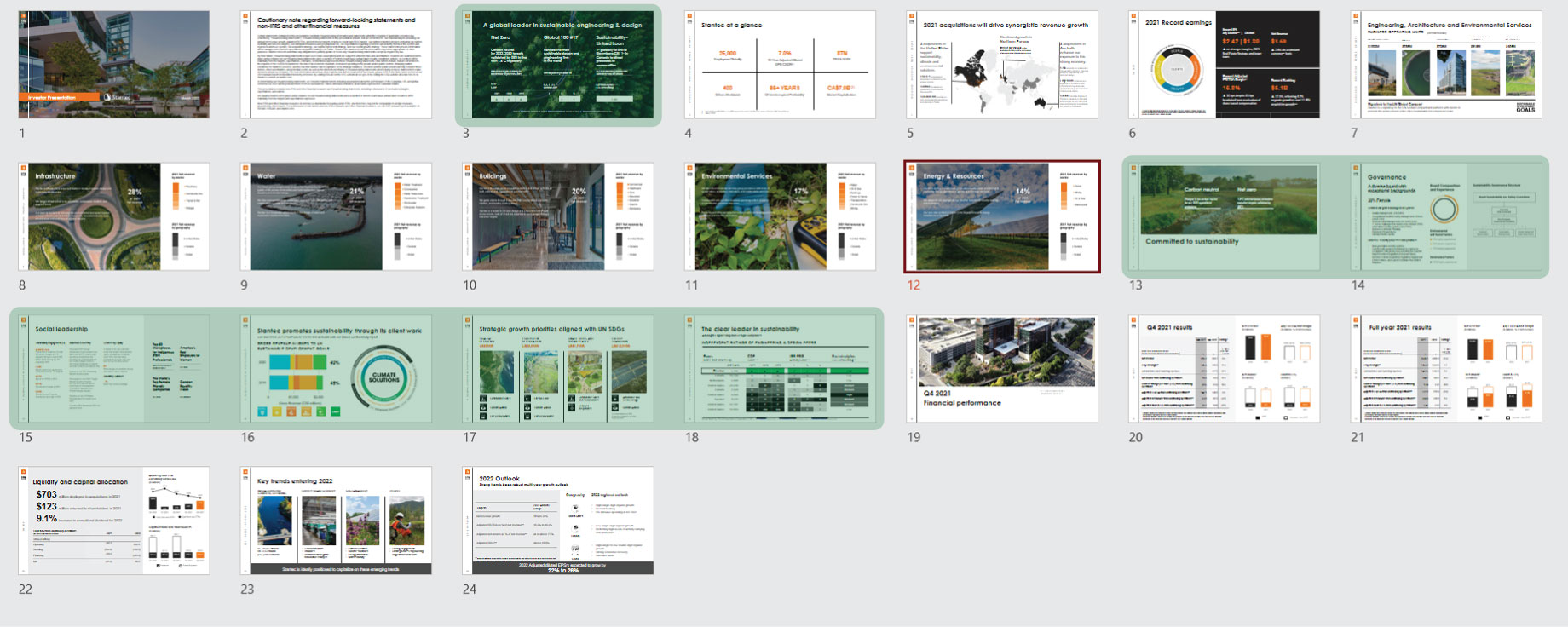

Within one year, all that would change. Almost a third of Stantec’s deck is now dedicated to ESG (shown in green).

Selecting the right sustainability frameworks

Few companies have the resources available to report into all the ESG frameworks that have already emerged. And everyday a new framework enters the market. As a result, to respond to the sudden surge in interest for sustainability, a company must take care to select the right frameworks to report under. To save time, below are the frameworks we recommend and the rationale behind the recommendation:

- Report impact revenue through a dominant taxonomy. Be conservative, don’t get creative, and prepare to provide audit and assurance in the near future. It would be embarrassing, and likely destructive to shareholder value, to walk back exaggerated impact revenue claims down the road. Of note, the UN Sustainable Development Goal (UN SDG) framework correlates well with most ESG reporting frameworks and is gaining traction in North America as a means to report impact revenue.

- We expect the following sustainability performance frameworks to become the market’s dominant standards: The Global Resources Initiative (GRI), the Task Force on Climate-related Financial Disclosures (TCFD), CDP (formerly the Carbon Disclosure Project), and the Sustainable Accounting Standards Board (SASB). Companies should provide separate indexes for GRI, TCFD and SASB in their sustainability report.

- These sustainability rating agencies are expected to remain dominant: Sustainalytics, MSCI, and ISS.

- ESG data aggregators that will remain dominant include Bloomberg, S&P Global, Refinitiv and Moody’s/RMS.

Many of the data points required by the frameworks above are the same. As a result, it is possible to reduce the duplication of work and free up resources by implementing an ESG reporting platform like Workiva. What’s unique about Workiva is that it already supports direct SEC filings to EDGAR. With the SEC’s proposed rule to enhance and standardize the climate-related disclosures provided by public companies, SEC filing requirements are nearly a foregone conclusion.

Emission Reduction COMMITMENTS

Many companies have already announced carbon neutrality and net-zero commitments based on their own unique concept and approach. While most of these commitments are not tied to any standard, a standard is now emerging. The Science Based Targets initiative (SBTi) has a stringent validation process for near-term and long-term 1.5ºC science-based emissions reduction targets. We expect this to become the global standard going forward. If your company decides to declare an emissions reduction commitment, ensure that it conforms to SBTi to avoid the embarrassment of reneging on carbon commitments that turn out to be unattainable in the timeline your company has given itself.

Emission baseline considerations for ACQUISITIVE companies

It should be noted that emission reduction commitments work from a baseline. While establishing the baseline with SBTi is a laborious process, acquisitive companies need to repeat the process on a regular basis to avoid unfairly penalizing themselves.

The LEading ESG Frameworks are beginning to consolidate

The field of ESG has been in desperate need of consolidation for some time. On November 3, 2021, sanity prevailed and the IFRS Foundation introduced the International Sustainability Standards Board, consolidating CDSB and VRF. This effectively begins the consolidation starting with the SASB reporting framework. This is one of the most significant developments in the field of integrated reporting and sustainability to date, and will have major implications for issuers going forward.

Sustainability: A Necessity That primarily poses A downside risk At this point

The opportunity for any ESG related multiple expansion has passed for almost all companies in all industries. Sustainability is now a requirement. Enhancing your company’s sustainability performance over time has become the expectation, rather than a source of differentiation.

That said, deliberately choosing to frame a company’s story with a primary focus on sustainability means that it will be competing for capital in the “sustainability arena”. Given the other market participants in this arena, this is likely an uphill battle for most companies. Remember that you can choose to frame your story to compete for capital in a different arena that plays to your company’s strengths while continuing to improve your sustainability performance.

Conclusion

Sustainability and investor relations may have become the new Gordian knot. But simply injecting your company’s investor and corporate materials with ESG catch phrases will do nothing to enhance shareholder value over the long-term. It may, infact, expose your company and its shareholders to significant risks.