Accredited Institutions

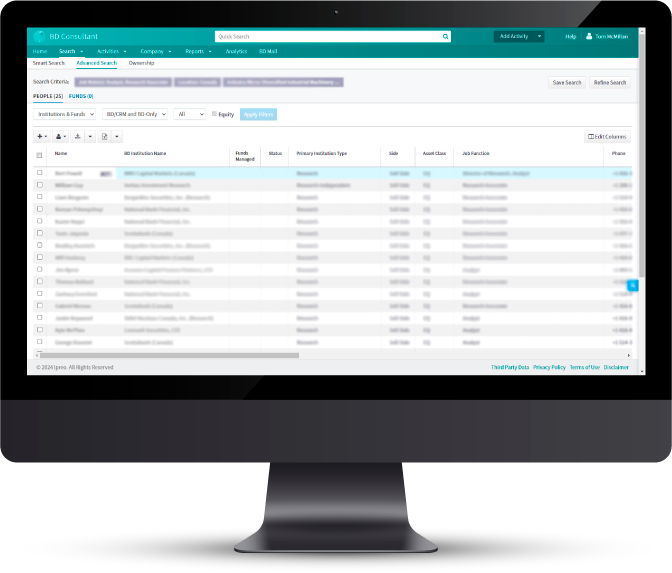

Strategic investor targeting at the institutional and fund manager level should be conducted with the aid of S&P BD Corporate, the world’s leading investor targeting platform. No other platform has the quality of ownership data that BD Corporate delivers, and when it comes to investor targeting, garbage in means garbage out. The three different approaches MCI uses to target institutions include:

- Peer analysis – to identify buyers of your peers (the most basic level of targeting).

- Quantitative analysis – to identify suitable buyers of companies that are quantitative analogues that also have significant buying power.

- Thematic analysis – to identify suitable buyers with significant buying power of companies that match significant investment themes.

Depending on your team’s preference and goals, you can gate the audience by geography as well as remove your company’s current owners from campaign consideration. The end result should be a list of institutions that are actively buying in the space.

Brokers & Retail

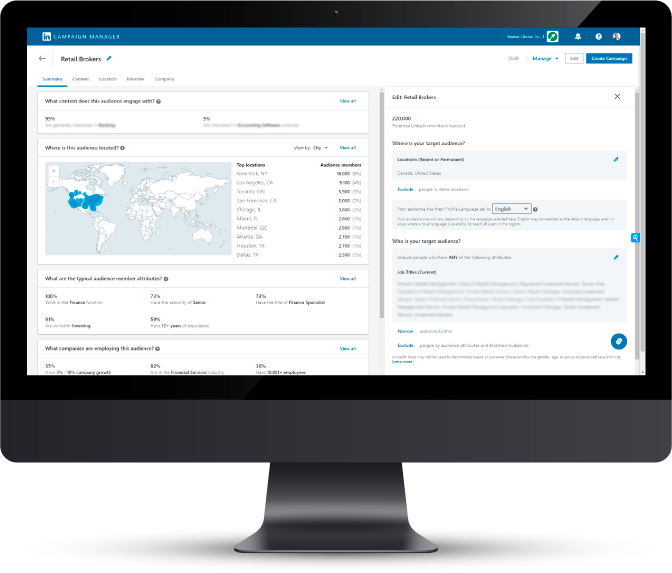

Strategic investor targeting at the individual or retail broker level leverages key demographic targeting criteria available within the various digital channels available. Rather than defining institutional targets as discussed above, we define these targets based on job roles, location, etc.