Beyond management’s fiduciary obligation to enhance shareholder value, a well managed public listing is an important asset that should contribute to your company’s long-term success. Conversely, the poor performance of a carelessly managed public listing will almost certainly impair your company through:

- A higher cost of capital and its limitations;

- Shareholder activism;

- Predatory / unsolicited bids to acquire control;

- Loss of management credibility; and

- Reduced total compensation for employees.

Any company can experience an unfair discount in their value. Unfair discounts arise when the market does not understand or is unaware of a company’s value proposition and relevance. Discounts also arise when a company competes for capital in the wrong arena. Both scenarios cause analysts and investors to assign an inappropriate value to a company.

Unlock and Enhance Shareholder Value

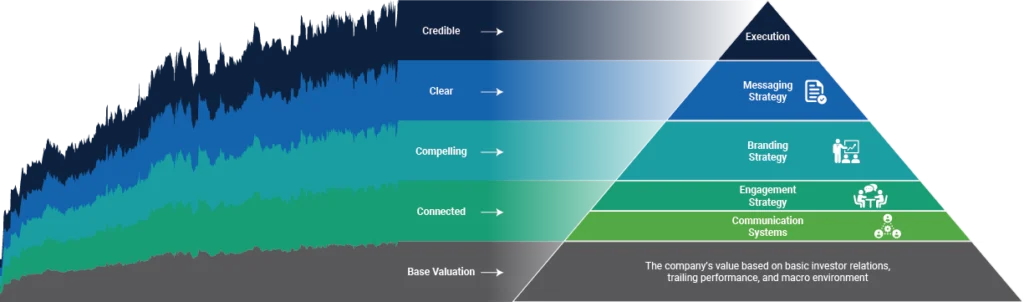

Your investor relations program should efficiently and effectively drive a premium valuation. According to a recent report from S&P Market Intelligence, best-in-class investor relations drives a 34% valuation premium relative to peer companies. In our experience, solid execution by management, combined with sound messaging, branding, and engagement strategies can spur a significant turnaround in a company’s valuation.

The Fair Valuation Framework can resolve unfair discounts to unlock and enhance shareholder value. Over the long-term, this framework will also mitigate the harmful effects described above. The four Cs of the Fair Valuation Framework ensure that your company’s message is credible, clear, compelling and connected:

The Four Cs of Capital Markets Engagement

It’s one thing to talk about attaining a premium valuation… It’s something else entirely to operationalize its delivery. While being credible, clear, compelling, and connected are all necessary to achieve your company’s maximum sustainable valuation, in isolation they are insufficient. The four Cs of capital markets engagement must be layered together to drive a premium valuation. Companies who are executing well, but suffer from an unfair discount in the market, have a breakdown in one or more of the operational components that are supposed to be delivering the four Cs.

Credible – Trust is the foundation of your company’s valuation

Credible and trustworthy behavior is the foundation of a company’s valuation. This starts with sound execution by a competent management team. We help management teams build trust in the marketplace by telegraphing the milestones they are working towards, and then providing tangible evidence of achievement and progress towards these overarching goals. By ensuring management sets realistic expectations, avoids promotion, and maintains credible practices, we help our clients earn the market’s long-term trust.

Clear – People only invest in what they understand

Does the market understand your business story? Clear communication enhances investor understanding and shapes positive market sentiment. Investors don’t put their money into businesses they don’t understand. So while your competitors leave their investors confused with jargon, acronyms, and legalese, we will develop and execute a messaging strategy for you that clearly conveys the bigger picture. We will translate your story into simple and clear language so that it is understood by all audiences, not just specialists. This requires straightforward language and concepts that resonate with generalist investors. Learn more about how we help companies to be clear here.

Compelling – Attract investor share of mind

Compelling communications and events that attract investor interest and attention are what set you apart from your peers. Even if your company’s customer facing communications have a strong brand, your investor facing communications may not. Your appearance and professionalism as experienced through your website, reporting, investor presentation, events, and other mediums matters to investors. You should be conveying a look and feel that gives investors confidence in your company’s long-term prospects. A sound investor facing brand strategy, backed by sufficient design resources, is required to achieve this. We can deliver investor presentations, webcasts, in-person events, websites, and other investor mediums that punch well above your company’s size and weight to propel you to the front of the pack.Learn more about how we help companies deliver a compelling story here.

Connected – Get the right people into Your Story

Even the best story in the market is meaningless if it doesn’t reach the right audience. Do you have the right relationships in the capital markets? These crucial relationships make all the difference to a company’s trajectory, but are more difficult than ever to identify, target and build. Disruption, caused by new technologies and regulations, mean:

- Equity sales desks have shrunk to a fraction of their former size – this means new buy side relationships are more difficult to forge;

- Fewer analysts are stretched to cover more companies – this makes it more difficult to garner and maintain accurate research coverage;

- Funds have moved from active portfolio managers to passive investment vehicles – which means there are fewer active portfolio managers to target; and

- Brokers are weighed down with new regulations and compliance requirements – which means there are fewer resources to apply to your story.

Even large-cap companies struggle to navigate the increased complexity of today’s market. To build effective long-term connections in the capital markets, we deploy an engagement strategy that targets all levels of the sell side and buy side. Our clients “own” their capital market relationships through communication and relationship management systems that nurture and maintain these relationships over the long-term. This provides management teams with a critical advantage when facing the ever-present risk of shareholder activism. Find out how we help companies connect meaningfully with the capital markets here.

The Fair Valuation Framework in Action

Trailing performance, the macro economic environment, market awareness, and market expectations define a company’s base valuation. Each element of the fair valuation framework layers additional market value on top of a company’s base valuation. By resolving misperceptions, clarifying the message, layering in compelling communication tools, and connecting the entire package to the right people in the investment community, we can help any company achieve a premium valuation.